How investment incentives work in the Czech Republic

Investors who place their investments in Czechia can obtain aid in the form of investment incentives, which are provided pursuant to Act No. 72/2000 Coll., on Investment Incentives, as amended.

Czech and foreign legal entities and natural persons engaged in business can apply for investment incentives. Only a legal entity with its registered office in the Czech Republic can be a recipient of investment incentives.

General eligibility criteria

For all types of activities, it further applies that the recipient shall not start work on the given project (i.e. shall not acquire any assets including orders of machinery and equipment and shall not commence construction works) prior to submitting the incentives application to CzechInvest. All of the conditions must be fulfilled within three years from the issuance of the Decision to Grant Investment Incentives and the recipient shall retain the assets and created jobs throughout the entire period of utilising state aid, at least for a period of five years.

State aid |

|

|

Size of company |

% of eligible costs |

|

Large |

20-40 |

|

Medium-sized |

30-50 |

|

Small |

40-60 |

Note: In the case of large enterprises, only new economic activity can be supported in the following regions: Plzeň, Central Bohemia, South Bohemia, Vysočina, South Moravia. This restriction does not apply to other regions.

Sample calculation

The investor (large enterprise) plans to invest a total amount of EUR 6 million in assets in a technology centre. The state-aid intensity is 40% of eligible costs. Therefore, the maximum state-aid ceiling is EUR 2.4 million. The maximum amount of state aid may be utilised in the form of corporate income-tax relief for ten years and cash grants for job creation. Cash grants for training and retraining of employees are provided above the state-aid ceiling, i.e. as cash in addition to the previously mentioned EUR 2.4 million.

Application process

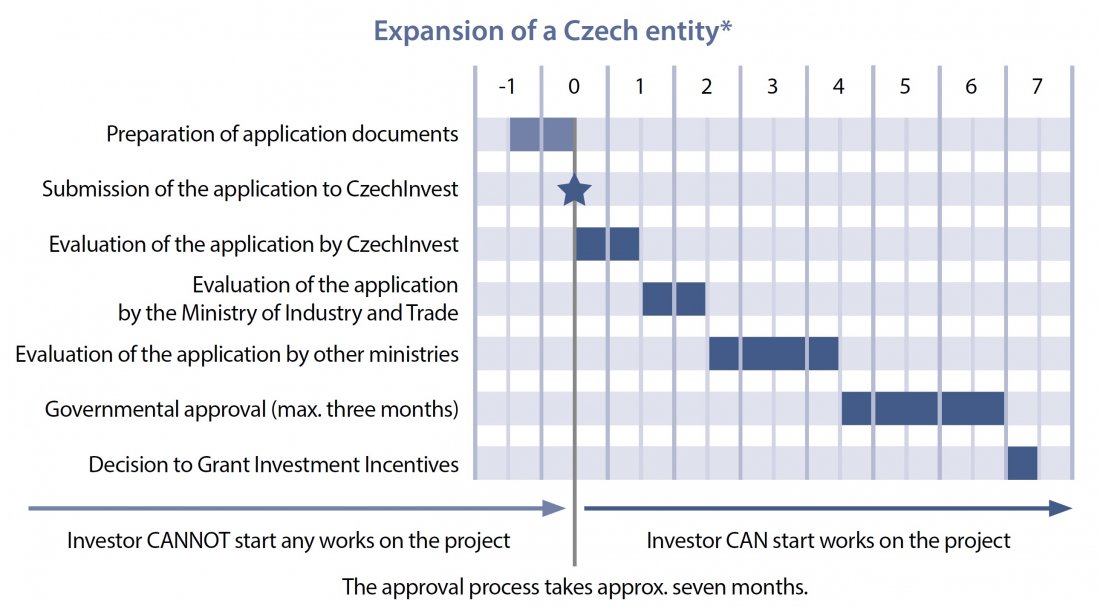

The process of applying for investment incentives differs depending on whether the investor is initiating a new investment or an expansion of an existing investment. In both cases, the incentives application has to be approved by the Czech Government based on the anticipated benefits of the project for the region and for the state budget. A recent amendment to the Investment Incentives Act extended the application process.

In the case of expansion of an investment, it is a single-round process described in the scheme below:

Source: CzechInvest, 2024

Extended two-round process in the case of initiating a new investment: This process involves the establishment of a new Czech legal entity. The investor can start implementing the investment immediately after submitting the application; it is not necessary to wait for issuance of the aforementioned decision.

Supported areas |

||

|

Manufacturing industry |

Technology centres |

Business support services centres |

|

Introduction or expansion of production

|

Construction or expansion of R&D centres

|

Construction or expansion of shared-services centres |

|

Construction or expansion of software-development centres |

||

|

Construction or expansion of high-tech repair centres |

||

|

Construction or expansion of data centres |

||

|

Source: CzechInvest, 2023 |

||

Forms of investment incentives

- Corporate income-tax relief for companies for a period of up to ten years. For new companies, this incentive is provided in the form of full tax relief; for existing companies, in the form of partial tax relief.

- Cash grants for job creation in technology centres in the amount of EUR 7,800 per each new job created. An investment in production can receive a cash grant for job creation only in regions with an unemployment rate of at least 7.5%.

- Cash grants for acquisition of assets for strategic investments in the manufacturing industry in the amount of up to 20% of eligible investment costs; in technology centres and high-tech repair centres, up to 20% of eligible investment costs. This type of support must be approved by the Czech government.

- Cash grants for training and retraining of new employees in technology centres in the amount of 50% of training costs. An investment in production can receive a cash grant for training and retraining only in regions with an unemployment rate of at least 7.5%.

Eligibility criteria

- Manufacturing industry: Investment of EUR 1.6 - 3.2 million depending on the region, half of which must be invested in new machinery + the condition of high value-added in regions with an unemployment rate under 7.5%.

Definition of the high-value-added condition |

|||

|

Employees are paid at least the average wage in the region |

+ one of the following conditions A) or B) or C)

|

A) At least 10% employees must hold university degree and active collaboration with R&D institutions must account for 2% of eligible costs |

|

|

B) R&D employees must comprise at least 3% of the staff |

|||

|

C) Investment of 10% of eligible costs in machinery for R&D purposes |

|||

|

Source: CzechInvest, 2023 |

|||

- Technology centres: Investment of EUR 0.4 million, half of which in new technology + creation of 20 new jobs

- Business support services centres: creation of 20-70 new jobs depending on the type of BSS. Services must be provided in at least three countries.

The required investment is reduced to one-half of the stated amounts for medium-sized enterprises and to one-quarter for small enterprises. The required number of new jobs is reduced to one-half of the stated amounts for SMEs.

Eligibility criteria for strategic investments |

||

|

|

Min. investment in EUR million |

Min. number of new jobs |

|

Manufacturing industry |

80 |

250 |

| Production of strategic medical products | 3.2/1.6 | N/A |

|

Production with high technological complexity* |

3.2/1.6 |

N/A |

|

Chip production, E-mobility and energy saving** |

3.2/1.6 |

N/A |

|

Technology centres |

8 |

70 |

|

High-tech repair centres |

8 |

100 |

|

Source: CzechInvest, 2023 |

||

Note: Half of the investment must go into new machinery.

Note: *(CZ NACE sections 21 and 26 and group 30.3).

Note:**(Exact list of products)

Eligible costs

- Long-term tangible and intangible assets, whereas the value of machinery must comprise 50% of eligible costs.

- Two years’ gross wages of employees in newly created positions.The investor must select one option.

In the period from 1998 to 31 December 2023, a total of 1,323 Decisions to Grant Investment Incentives were issued on the basis of registered applications. In the period from 1998 to 2023, investors committed to investing more than approx. EUR 34 billion and creating 203,536 new jobs.

|

David Pejšek |

|