Offices

The office market in the Czech Republic has continued to prove its resilience throughout the recent challenging years. With the current geopolitical situation and right-shoring trend emerging from the pandemic, the country is becoming even more attractive to foreign investors.

Prague, the obvious choice

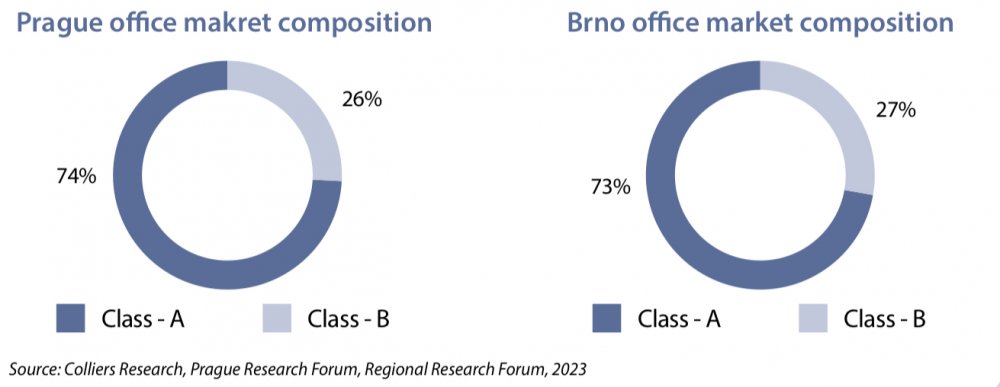

When it comes to finding office space in the Czech Republic, the capital city is the obvious first choice for many. Many market newcomers are looking for offices here, as Prague is the heart of the country’s cultural, economic and political life. The local market comprises approximately 3.9 million square metres of modern office space. Despite the lower levels of new office supply over the past three years, developers have been able to provide a decent inflow of modern properties with very high standards. Together with further strengthening of the market in the most sought-after locations in Prague’s historical centre, the Karlín and Rohan areas of Prague 8 and Pankrác and Brumlovka in Prague 4, developers are also establishing new locations with projects such as Roztyly, Hagibor and Smíchov City. Efforts to create a connected city of short distances are also evident and will continue. The vacancy rate in the market remains between 7% and 8% and was not significantly affected by any of the challenges faced by other markets. Some micro-locations may even have lower office availability, as the established submarkets often draw attention with an excellent choice of amenities and well-functioning public transport.

Brno, the leading regional city

Brno is a stable market with modern office stock approximately six times smaller than that of Prague, but the city definitely does not lack modern office buildings and impressive architecture. The office market is concentrated in and south of the Střed district and historical city centre, but there are also a number of interesting projects to the north and east. Newly built office hubs like Vlněna, Spielberk and many others form a resilient core for further growth. In future, we can expect impressive new projects like Dornych, buildings within the Nová Zbrojovka area, and new additions to Ponávka and Vlněna Office Park. These activities are being carried out mainly by local developers with extensive knowledge of the market and the goal of always providing the highest possible quality and value added with their projects.

Ostrava and other cities

Ostrava is the third largest city in the Czech Republic country and also has the country’s third largest office market. Though its modern office stock is relatively small, modern properties comparable to those in Prague and Brno can be found throughout the city. Established office centres are home to world-class business- service centres and new projects, such as the recently completed Organica, another award-winning addition to Ostrava’s office-market map.

In the rest of the country, local developers are pushing through many projects, especially in well-connected cities like Plzeň, Hradec Králové and Olomouc. Such projects, either already existing or in the planning stage, are of high quality and offer excellent services to their clients. Thanks to lower operating costs, choosing to establish the office in smaller cities can prove economically viable, but also more difficult to find.

Summary

Despite the Europe-wide economic slowdown, the Czech office market can attract new tenants through competitive market conditions such as high property standards, an innovative environment and a skilled, well-educated and talented workforce. Supported by the beautiful, picture-postcard appearance of Czech cities, high level of safety, high standard of living and its location in the heart of Europe, the Czech Republic should always be on any investor’s list of expansion options.

Prague, the obvious choice

When it comes to finding office space in the Czech Republic, the capital city is the obvious first choice for many. Many market newcomers are looking for offices here, as Prague is the heart of the country’s cultural, economic and political life. The local market comprises approximately 3.9 million square metres of modern office space. Despite the lower levels of new office supply over the past three years, developers have been able to provide a decent inflow of modern properties with very high standards. Together with further strengthening of the market in the most sought-after locations in Prague’s historical centre, the Karlín and Rohan areas of Prague 8 and Pankrác and Brumlovka in Prague 4, developers are also establishing new locations with projects such as Roztyly, Hagibor and Smíchov City. Efforts to create a connected city of short distances are also evident and will continue. The vacancy rate in the market remains between 7% and 8% and was not significantly affected by any of the challenges faced by other markets. Some micro-locations may even have lower office availability, as the established submarkets often draw attention with an excellent choice of amenities and well-functioning public transport.

Brno, the leading regional city

Brno is a stable market with modern office stock approximately six times smaller than that of Prague, but the city definitely does not lack modern office buildings and impressive architecture. The office market is concentrated in and south of the Střed district and historical city centre, but there are also a number of interesting projects to the north and east. Newly built office hubs like Vlněna, Spielberk and many others form a resilient core for further growth. In future, we can expect impressive new projects like Dornych, buildings within the Nová Zbrojovka area, and new additions to Ponávka and Vlněna Office Park. These activities are being carried out mainly by local developers with extensive knowledge of the market and the goal of always providing the highest possible quality and value added with their projects.

Ostrava and other cities

Ostrava is the third largest city in the Czech Republic country and also has the country’s third largest office market. Though its modern office stock is relatively small, modern properties comparable to those in Prague and Brno can be found throughout the city. Established office centres are home to world-class business- service centres and new projects, such as the recently completed Organica, another award-winning addition to Ostrava’s office-market map.

In the rest of the country, local developers are pushing through many projects, especially in well-connected cities like Plzeň, Hradec Králové and Olomouc. Such projects, either already existing or in the planning stage, are of high quality and offer excellent services to their clients. Thanks to lower operating costs, choosing to establish the office in smaller cities can prove economically viable, but also more difficult to find.

Summary

Despite the Europe-wide economic slowdown, the Czech office market can attract new tenants through competitive market conditions such as high property standards, an innovative environment and a skilled, well-educated and talented workforce. Supported by the beautiful, picture-postcard appearance of Czech cities, high level of safety, high standard of living and its location in the heart of Europe, the Czech Republic should always be on any investor’s list of expansion options.