Banking

The Czech banking sector is unique in many respects. Most of the sector is dominated by strong European financial groups and its activities are primarily focused on the Czech Republic.

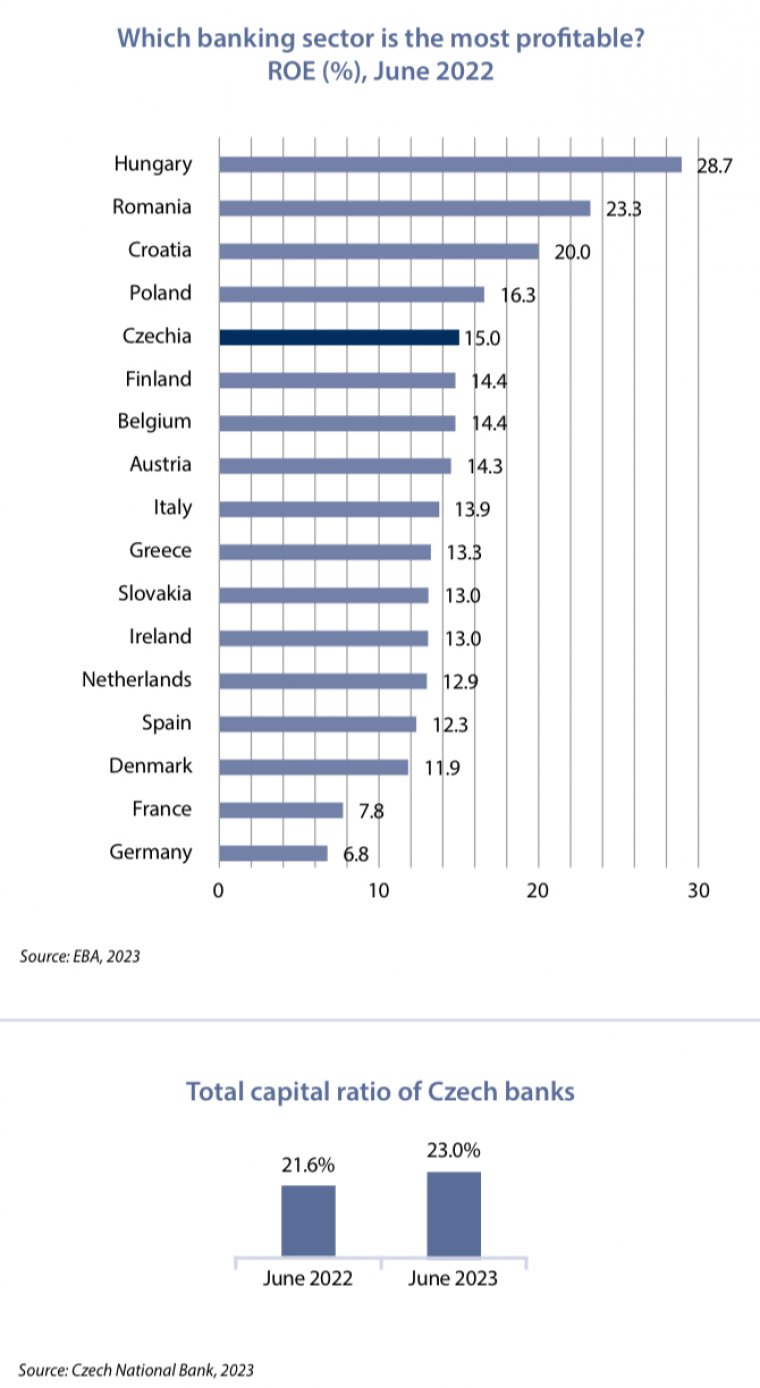

Capital position

Czech banks remain well-capitalised despite the impressive growth they have shown over the past two decades and the total level of capitalisation is well above all regulatory requirements. With capital adequacy at 23% (June 2023), Czech banks have maintained a solid position confirmed by the latest (June 2023) stress tests performed by ČNB. Czech banking sector remains resilient against the economic impact of Russian invasion to the Ukraine thanks to its profitability and low exposure to both countries. Loan portfolio of failed Sberbank was successfully acquired by Česká spořitelna.

Profitability

Czech banks are among the most profitable in Europe. With ROE around 15% (June 2023), Czech banks have generated attractive returns for their shareholders in a global comparison. Profitability of the Czech banking sector is supported by the benign environment including a strong macro picture, a prudent supervision, and a friendly investment environment.

After record profitability of Czech banking sector in 2022 supported by high interest rate environment and outstanding portfolio quality it has been normalizing in 2023 reflecting increasing cost of funds and high inflationary environment. Cancellation of remuneration of minimum obligatory reserves by ČNB and windfall tax introduction will furthermore negatively influence profitability development. Efficiency measures supported by digitisation should on the other hand partly offset these effects. Portfolio quality remains outstanding with non-performing loans below 2% (August 2023).

Volume development

In 2023, ČS expects client loans in Czech market to rise by 4.7% y/y. Over recent months, demand for housing loans improved somewhat while consumer credit seems not to have suffered despite pressure on households‘ spending due to high energy prices. A revival of loans to corporates on the back of after-pandemic macroeconomic boom has slowed, likely hurt by an invasion-generated uncertainty and rising euro lending rates.

The currency split of loans in the Czech banking sector shows that foreign currency lending is mostly denominated in EUR and predominantly in the corporate segment where it became increasingly popular in 2023.

For 2023, ČS expects total client deposits in Czech market to rise by 7.4% y/y. Shift to from current accounts to higher interest-bearing products and investment products reflects high interest rate environment. The pressure on firms' and households‘ budgets from high energy costs has been easing after energy prices decreased.

Opportunities

Further loan growth can be anticipated, as penetration still lags behind developed Europe; compared to other EU countries, the Czech market is still underpenetrated in both loans to households and corporate loans. In other words, the convergence story continues and there is still significant room to grow faster than the EU even in other product categories (e.g., investment funds and life insurance) subject to differences in national legal framework.

Despite all the challenges that 2023 brought, Czech banking sector confirmed its resilience and stability and managed to provide strong support to households, companies and the public sector and is ready to further contribute to stronger and sustainable society. The main risk for the future remains uncertainty about the development with respect to war in the Ukraine.

| Juraj Garaj Head of Group Controlling and IR team Česká spořitelna JGaraj@csas.cz www.csas.cz |